Amidst Ups and Downs, the Market Closed With a Decline; Nifty Prediction for Tomorrow

Nifty Prediction for Tomorrow

Comprehensive Analysis of Stock Market Trends: Nifty’s Downturn and Sectoral Dynamics

The intricacies of the stock market often present a dynamic and ever-changing landscape, shaped by various factors ranging from global economic conditions to sector-specific news.

In this extensive analysis, we delve into the recent trends witnessed in the Indian stock market, particularly focusing on the Nifty index, top gainers and losers, sectoral movements, and expert opinions on the prevailing market scenario.

Market Overview:

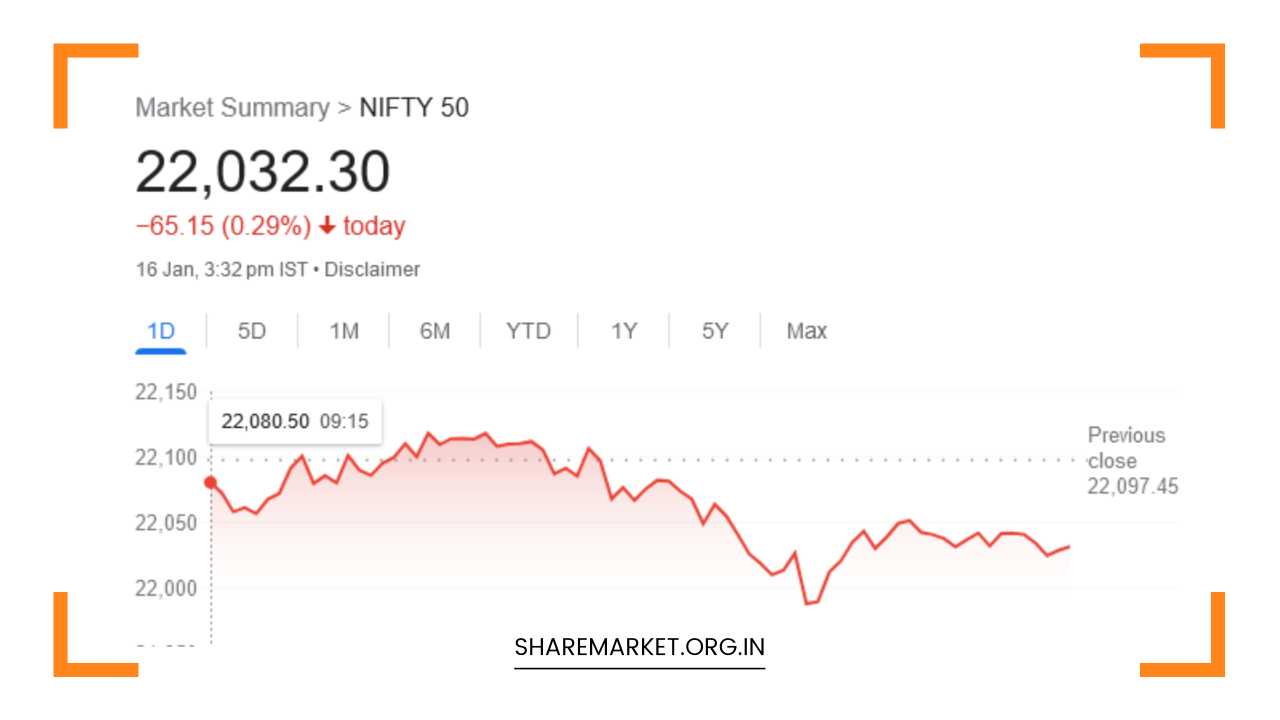

As of January 16, the stock market exhibited a noteworthy shift in momentum, interrupting a commendable five-day surge.

The benchmark indices, Sensex and Nifty, underwent a decline at the close of trading. Sensex, reflecting the overall market sentiment, dropped by 199.17 points (0.27 percent) to settle at 73,128.77.

Meanwhile, the Nifty faced a decline of 65.20 points (0.30 percent), closing at 22,032.30. These figures indicate a pause in the recent bullish trend, prompting a closer examination of the market dynamics.

A nuanced look at the market reveals a mix of advancing, declining, and unchanged shares. Specifically, 1192 shares witnessed an increase, 2315 faced a decline, and 61 remained unchanged.

The BSE Midcap and Smallcap indices, considered indicators of broader market trends, both experienced a decline of 0.3 percent.

This indicates a correction in the broader market, shedding light on the complexity of market movements.

Sectoral Performance:

Understanding the sectoral performance is crucial for grasping the nuances of market dynamics. The top gainers in the Nifty included BPCL, Tata Steel, Titan Company, ITC, and Maruti Suzuki.

On the flip side, the top losers comprised Divis Laboratories, HCL Technologies, Wipro, NTPC, and SBI Life Insurance.

These observations highlight the divergent movements within various sectors, showcasing the diverse nature of the market.

Sectoral indices provide further insights into market movements. There was a notable 1 percent increase in the Metal and Oil and Gas indices.

This upswing suggests a positive sentiment in these sectors. In contrast, the Power, Realty, Health Care, and IT sectors observed declines ranging from 0.5 to 1.5 percent.

Such fluctuations emphasize the importance of sector-specific analysis for investors seeking to make informed decisions.

Expert Opinions:

Market experts play a pivotal role in deciphering the underlying factors driving market movements. Vinod Nair, an expert from Geojit Financial Services, attributes the recent market downturn to profit booking in the broader market.

This profit booking comes on the heels of a strong performance by the IT sector amidst weak global signals. Investors are displaying caution due to the expensive valuations of mid and small-cap stocks.

The absence of new triggers, coupled with mixed sentiments among Foreign Institutional Investors (FIIs), contributes to the prevailing uncertainty in the market.

Despite geopolitical tensions, oil prices remain stable, and the recent rise in the Index of Industrial Production (IIP) suggests continued softness in the near term.

Aditya Gaggar, Director of Progressive Shares, provides additional insights into the market dynamics. He notes that the market commenced the day on a weak note, with IT and pharma stocks witnessing declines due to profit booking.

However, subsequent buying in metal stocks, fueled by news of a stimulus plan in China, provided support to the Nifty.

Despite this positive development, the Nifty closed at 22,032.30, marking a decline of 65.15 points. Gaggar’s analysis underlines the importance of staying attuned to global developments, which can significantly impact specific sectors and, consequently, the overall market.

Technical Analysis:

A more granular analysis of market trends involves technical indicators that provide insights into potential future movements.

On the daily chart for Nifty, a Spinning Top candlestick pattern has emerged, suggesting a potential bearish divergence.

This pattern indicates indecision in the market and potential reversal. The current resistance level is identified at 22,120, while support is evident at 21,930.

Jatin Gedia, an analyst from Sharekhan, emphasizes resistance around the psychological level of 22,000 on the daily chart. Additionally, a negative crossover in the Hourly Momentum indicator signals pressure on Nifty.

These technical indicators serve as valuable tools for traders and investors looking to make well-informed decisions based on market trends and potential reversals.

Looking at the current price and momentum setup, market analysts anticipate that Nifty will likely consolidate in the range of 21,900 to 22,200 in the short term.

During this consolidation phase, there may be stock-specific actions and sector rotations, prompting a cautious approach for investors. It is advisable to avoid aggressive long positions without strict adherence to stop-loss mechanisms.

Bank Nifty Analysis:

Shifting the focus to Bank Nifty, this segment of the market experienced a phase of consolidation, described as a short pause in a bullish environment.

Analysts express optimism about the continuation of the uptrend in the next few trading sessions. In the short term, Bank Nifty is anticipated to move towards the range of 48,650-49,000, indicative of the prevailing positive sentiment in the banking sector.

Concluding Thoughts:

In conclusion, the recent downturn in the stock market serves as a reminder of the dynamic and multifaceted nature of financial markets.

Sectoral fluctuations, expert opinions, and technical analyses collectively paint a comprehensive picture of the market scenario.

Investors are advised to tread cautiously, considering the potential for further consolidation and the need for vigilant risk management in the current market environment.

As the market continues to respond to both domestic and global factors, staying informed and adaptive remains crucial for navigating the uncertainties in the financial landscape.

In this ever-changing environment, a holistic understanding of market trends, combined with a strategic and disciplined approach, positions investors to make well-informed decisions and adapt to the evolving dynamics of the stock market.