Larsen & Toubro Stock: 5% Rise in 5 Days to New High – Future Forecast

Larsen & Toubro Share Price

L&T’s Stock Soars to New Heights: Unpacking the Factors Driving the Surge and Expert Opinions

On the 29th of September, L&T (Larsen & Toubro) shares enjoyed a prosperous day, reaching a new 52-week high.

This impressive streak of growth saw the stock rise by 5 percent over the course of the past five trading sessions.

The morning of that Friday saw the shares open at Rs 3044.15 on the BSE (Bombay Stock Exchange), and by the afternoon, they had surged to a 52-week high of Rs 3057, marking a 1.5 percent increase from the previous day’s closing price of Rs 3011.85.

This record-breaking performance followed a pattern, as the stock had already achieved a 52-week high just a day prior.

On the NSE (National Stock Exchange), the shares opened at Rs 3040 in the morning and swiftly rose to Rs 3058.35, reflecting a 1.5 percent gain from the previous closing price of Rs 3010, setting a new 52-week high for the stock on NSE as well.

The Surge Explained

The surge in L&T’s stock can be attributed to several factors. Firstly, the company’s construction arm secured a substantial order from the Mumbai Metropolitan Region Development Authority (MMRDA).

This mega order entails the design and construction of an underground road tunnel project connecting Orange Gate and the Eastern Freeway to the Marine Drive Coastal Road.

The project’s primary route will run beneath Sardar Vallabhbhai Patel Road and is slated for completion within 54 months, according to L&T’s statement to the stock exchanges.

Another contributing factor to the stock’s rise is the positive response to L&T’s share buyback program worth Rs 10,000 crore.

This buyback initiative commenced on September 18 and concluded after the close of trading on September 28. It offered 3.13 crore shares, with a maximum buyback price of Rs 3200 per share.

Expert Opinions

In terms of brokerage opinions, global firm Jefferies has maintained its ‘buy’ rating on L&T, citing the company’s consistent influx of orders.

Jefferies noted that L&T is witnessing an increase in capital expenditure in its key markets, particularly India and the Middle East. Similarly, analysts at UBS anticipate the bullish trend in L&T’s stock to persist, and they have raised the target price to Rs 3,600 per share.

Their projections indicate that the company is poised for a 17 percent CAGR in core sales and a 32 percent CAGR in EPS (Earnings Per Share) for the fiscal years 2023 to 2026.

This positive outlook is driven by the company’s strong order book and growth prospects in its core markets.

Market Context

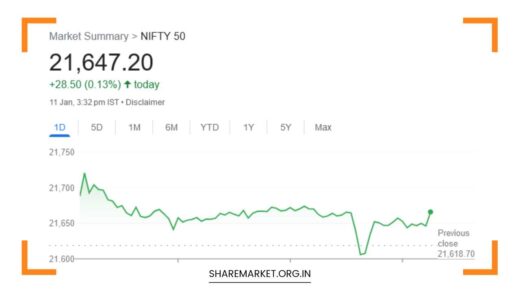

To delve deeper into this surge in L&T’s stock, it’s essential to consider the broader economic and market context.

The stock market, in general, has been experiencing significant fluctuations and reactions to various economic indicators and corporate news.

Amidst this backdrop, L&T’s performance stands out as a testament to the company’s resilience and its ability to capitalize on strategic opportunities.

The infrastructure sector, in which L&T plays a pivotal role, has been a focus of attention due to increased government spending on infrastructure projects in India.

The government’s emphasis on infrastructure development, particularly in sectors like roads, highways, and urban infrastructure, has created a favorable environment for companies like L&T to secure substantial contracts.

Economic Recovery and Global Events

The mega order from MMRDA for the construction of an underground road tunnel project is a significant milestone for L&T.

It not only adds to the company’s order book but also reinforces its reputation for executing complex infrastructure projects.

The 54-month timeline for project completion underscores the company’s commitment to delivering quality infrastructure within stipulated timelines.

Furthermore, L&T’s share buyback program has garnered substantial investor interest. Share buybacks are often seen as a way for companies to return excess cash to shareholders and signal confidence in their financial health and growth prospects.

The fact that L&T’s buyback was oversubscribed indicates strong investor confidence in the company’s future performance.

Investor Sentiment

In the broader market context, investors are closely monitoring the economic recovery and the impact of global events on financial markets.

The COVID-19 pandemic has had far-reaching effects on economies and financial markets worldwide, leading to increased volatility and uncertainty.

In such an environment, companies with a strong track record, like L&T, are seen as safe havens for investors looking for stability and growth potential.

Jefferies’ ‘buy’ rating on L&T reflects their optimism about the company’s ability to navigate these uncertain times successfully.

They point to the increase in capital expenditure in India and the Middle East as a positive sign, as it indicates growing demand for infrastructure projects in these regions.

Future Growth Prospects

UBS’s target price revision and growth projections for L&T underscore the company’s long-term growth potential.

The anticipated 17 percent CAGR in core sales and 32 percent CAGR in EPS over the next few years suggest that L&T is well-positioned to capitalize on the opportunities in its key markets.

Final Thoughts

In conclusion, L&T’s recent stock performance is a reflection of its strategic wins, such as the mega order from MMRDA, and the positive market response to its share buyback program.

These factors, combined with a favorable economic environment for infrastructure development, have contributed to the stock’s rise to a new 52-week high.

While the broader market remains volatile, L&T’s strong fundamentals and growth prospects make it an attractive option for investors seeking stability and long-term gains in the Indian stock market.